Empowering Australians to Preserve and Enjoy their Wealth.

Our Story

Established in 2015, Manning Asset Management was founded to protect and grow investors' wealth throughout market cycles by investing strategically and managing actively.

We believe that a disciplined yet dynamic approach, which involves navigating between sectors with varying risk and return characteristics, can unlock capital preservation while realising the full return potential of the asset class.

Experts in Dynamic Stability

Our dynamically balanced approach is designed to deliver a strong level of income with optimal risk-adjusted tolerance.

As markets shift and opportunities and risks arise, we adapt and actively respond to generate stability and performance throughout market cycles.

Specialist expertise

Deep experience in managing fixed income funds built to perform through market cycles

Strategic approach

We protect and grow wealth by investing strategically and managing actively

Proprietary process

10-step, 100+ point due diligence process designed to minimise risk exposure

Protecting and Growing Wealth, in All Weather and All Times

We dynamically manage portfolios through various market cycles to actively manage risk and sector exposure, while taking advantage of market opportunities.

*Past performance is not necessarily indicative of future performance. Returns are net of fees, excluding tax, and assume reinvestment of all distributions.

News and Insights

May 2025 - Market Commentary

The Fund delivered +0.67% in May, 9.47% over 12 months and 9.24% annualised over three years continuing to deliver over 5% net return above the RBA cash rate.

Comparisons in Credit

Credit continues to attract significant investor interest, and with that comes a growing number of new funds and strategies seeking capital. Many of these advertise high yields and strong return profiles, often with terminology that suggests robust downside protection — such as “first ranking security,” “look-through LVRs,” or “first loss capital.” While these features can form part of a sound structure, they are not guarantees of quality in and of themselves. The technical detail matters — and so does the experience of the team assessing it. In credit, headline terms often obscure material differences in underlying risk. Without full access to the loan level data, transaction documentation, and enforcement mechanisms, it is exceptionally difficult to compare funds on a like-for-like basis. The same language can describe entirely different risk profiles.

Risk and Return

The Manning Monthly Income Fund has now delivered consistent monthly income for nearly a decade — with no negative monthly returns from credit losses. That track record reflects a clear and consistent investment philosophy: preserve capital first and pursue yield only where it is backed by robust asset-backed security and structural protections. We continue to see peers seek higher yields by moving up the risk curve — including concentrated exposures to subordinated debt, thinly capitalised counterparties, or more cyclical lending strategies. While these approaches may produce appealing near term returns, they can expose investors to elevated downside risk, particularly in a tightening economic environment. Our approach remains grounded in delivering resilient, repeatable returns, backed by institutional quality credit work, full transparency into the underlying assets, strong governance over every transaction and deliberate avoidance of complexity that can obscure risk.

Cash Drag and Deployment Timing

This month’s return of 0.67% was modestly softer than recent periods. This reflects a higher than usual average cash holding of approximately 13% during the month, as the Fund positioned for the expected settlement of several large transactions and lender drawdowns.

Such temporary cash balances are an inherent and prudent feature of this asset class. Unlike listed markets, deployment timelines are not always linear — and we will never compromise on asset quality or structure to maintain short term consistency. We expect this capital to be fully deployed across June.

As credit continues to evolve as an asset class, we believe the importance of experience, structure, and transparency will only increase. The Fund remains highly selective in its deployment and operates in a segment of the market where capacity is inherently limited by the quality and scale of opportunities that meet our criteria, as such, we remain disciplined about how and where we deploy capital.

Q1 2025 - Market Update

Josh Manning, Portfolio Manager and Founder presents the Q1 2025 market update for Manning Asset Management.

April 2025 - Market Commentary

The Fund delivered +0.78% in April, 9.61% over 12 months and 9.19% annualised over three years continuing to deliver over 5% net return above the RBA cash rate.

In recent weeks, we have seen Australian credit spreads, being the expected return on a specific credit-rated note, fluctuate and largely move wider, reducing the value of those assets. For those funds that have benefitted over the prior years from credit spreads moving lower, inflating the value of their underlying assets, this has seen lower returns of late versus previous periods, adding a degree of volatility to a historically low volatility holding in one’s portfolio.

Short Duration Assets

The Manning Monthly Income Fund targets so called short duration assets that have a shorter investment period. These assets enable us to more actively manage the portfolio according to our macroeconomic views while being less impacted by changes in credit spreads due to the shorter timeframe of repayments that must be adjusted. As we have seen considerably more relative value in private vs public markets, the Fund's return has been derived by investing in higher-yielding assets that have adequate structural credit supports rather than being reliant upon lower credit spreads to drive returns higher.

Impact from Widening Credit Spreads

In April, the Fund delivered 0.78%, with credit spreads moving wider, slightly reducing the return by approximately 0.03% (i.e. without changes in market conditions, the return would have been 0.81%). While macroeconomic factors naturally influence the valuation of the Fund’s holdings, their impact remains modest, reinforcing the strength of the investment approach. The Fund’s focus on short-duration, floating-rate, higher-yielding private assets with structural credit support continues to demonstrate resilience and stability in varying market conditions.

March 2025 - Market Commentary

The Fund delivered +0.81% in March, 9.69% over 12 months and 9.09% annualised over three years continuing to deliver over 5% net return above the RBA cash rate.

Throughout the history of the Fund (near 10-year track record), we have witnessed several global events that have caused financial markets, particularly equities, to experience significant sell-offs. A common theme in such sell-offs is not the known impact of the event, but rather the anticipation of it. In this instance, equity markets have reacted to the potential inflation, geopolitical, and social impacts of the tariffs, which are still largely to play out. While this reaction is commonplace for equities, credit involves a very different discipline, and our approach to such global developments is outlined below.

Our Investment Approach

As a specialist credit investor, our focus is not on potential buying opportunities or long-term projections of what might happen. Instead, we concentrate on near-term confidence around what is likely to happen and what that means for the adequacy of our downside structural protections. Our ultimate focus is on capital preservation, ensuring that our investments are well-protected and positioned for stability.

When financing pools of underlying loans that make up the Fund’s holdings, we negotiate structural protections with the lenders we fund across various areas. These protections can include arrears rates or levels of defaulting loans within a pool that exceed a predetermined threshold. Should these thresholds be breached, enhanced rights in the transaction documents are triggered. These rights can include requiring the lender to repurchase the loans from the pool, closing and running down the facility, or even allowing Manning to sell the underlying pool of loans to recover capital. Such protections are negotiated well in advance, and the skill lies in adequately considering the necessary protections, their levels, and being committed to exercising them when needed.

As economic conditions change and new economic information becomes available, we constantly assess the Fund’s holdings against its objective of delivering a strong and consistent income-based return through the economic cycle. Unlike equity markets, which reward those who can accurately predict the future, we focus and invest on a short and medium-term basis, ensuring our investments are well-protected and positioned for near-term confidence.

Portfolio Composition

Long-term readers will note that over the past few years, we have been shifting the portfolio towards loans secured by hard assets. Today, the portfolio is predominantly composed of loans secured by first-ranking mortgages and business loans with first-ranking charges over business-critical assets such as vehicles. We believe the profile of such assets is more resilient, liquid, and better suited to a less buoyant market than we have experienced in the post-COVID period. This strategic shift further aligns with our focus on capital preservation.

Market Impact and Fund Resilience

The global pullback in certain markets has impacted many investors. However, it demonstrates the importance of a highly diversified portfolio and specifically how the Manning Monthly Income Fund can cushion investors against broader market volatility while delivering a strong and consistent income stream to clients. The Fund now has a near 10-year track record and has never had a negative monthly loss from credit returns.

Key Focus Areas

Amidst the noise in the market and significant movements in major indices, we remain focused on what truly matters to us as Credit investors. We maintain a sharp focus on critical economic indicators such as employment levels, household balance sheets, and Australia's unique buffers against global macroeconomic events, including our floating rate currency, Federal government debt to GDP ratios, and monetary policy responses. Crucially, we concentrate on key segments of the Australian credit markets that have consistently demonstrated resilience across various market conditions. At the same time, we strategically avoid sectors that present heightened risks, such as unsecured corporate lending, project finance (including construction finance), and other illiquid forms of credit like agricultural lending.

Our approach integrates a forward-looking economic assessment with deep domain expertise in areas with proven long-term track records, creating a robust strategy to navigate increased market uncertainty. This powerful combination ensures we are well-prepared to adapt to evolving economic landscapes. By maintaining this disciplined approach, we aim to ensure the Fund's resilience and deliver strong, consistent returns. Our ultimate focus on capital preservation remains at the forefront of our strategy, guiding our decisions and protecting our investors' interests.

February 2025 - Market Commentary

The Fund delivered +0.68% in February (noting the 28 day month, this is equivalent to 0.75% for a 31 day month), 9.61% over 12 months and 8.95% annualised over three years continuing to deliver over 5% net return above the RBA cash rate.

Examining Australian Credit Markets

A rise in recent volatility has disrupted the longer-term theme of decreasing credit spreads, which historically has seen longer-term-to-maturity assets outperform short-dated equivalents, a trend we see likely reversing. Our investment thesis centres on buying short-dated assets, meaning a rise in volatility is welcomed. Increased volatility has the potential to increase the yield we can demand on a given security, while our existing portfolio value is only marginally impacted by these new yields. Opposingly, a fund buying longer dated assets will have less ability to ‘reset’ their portfolio into higher-yielding assets since capital isn't paid back as quickly and their current portfolio falling in value given the mark to market exposure.

At a time when equities have generally fallen in value, longer-dated assets have offered limited portfolio diversification. While it is too early to postulate if this rise in volatility is a point-in-time dynamic or if we are entering a new market dynamic, we anticipate a more material divergence in our Fund's performance vs peers that, in general, are more exposed to longer-dated assets.

New Investor Reporting

Following a 12-month process, we are pleased to release our enhanced investor reporting disclosure, as seen below, including a large portion of the portfolio being credit rated by an independent third party. We are pleased to provide this at a time when investor disclosure is paramount using industry best practice standards.

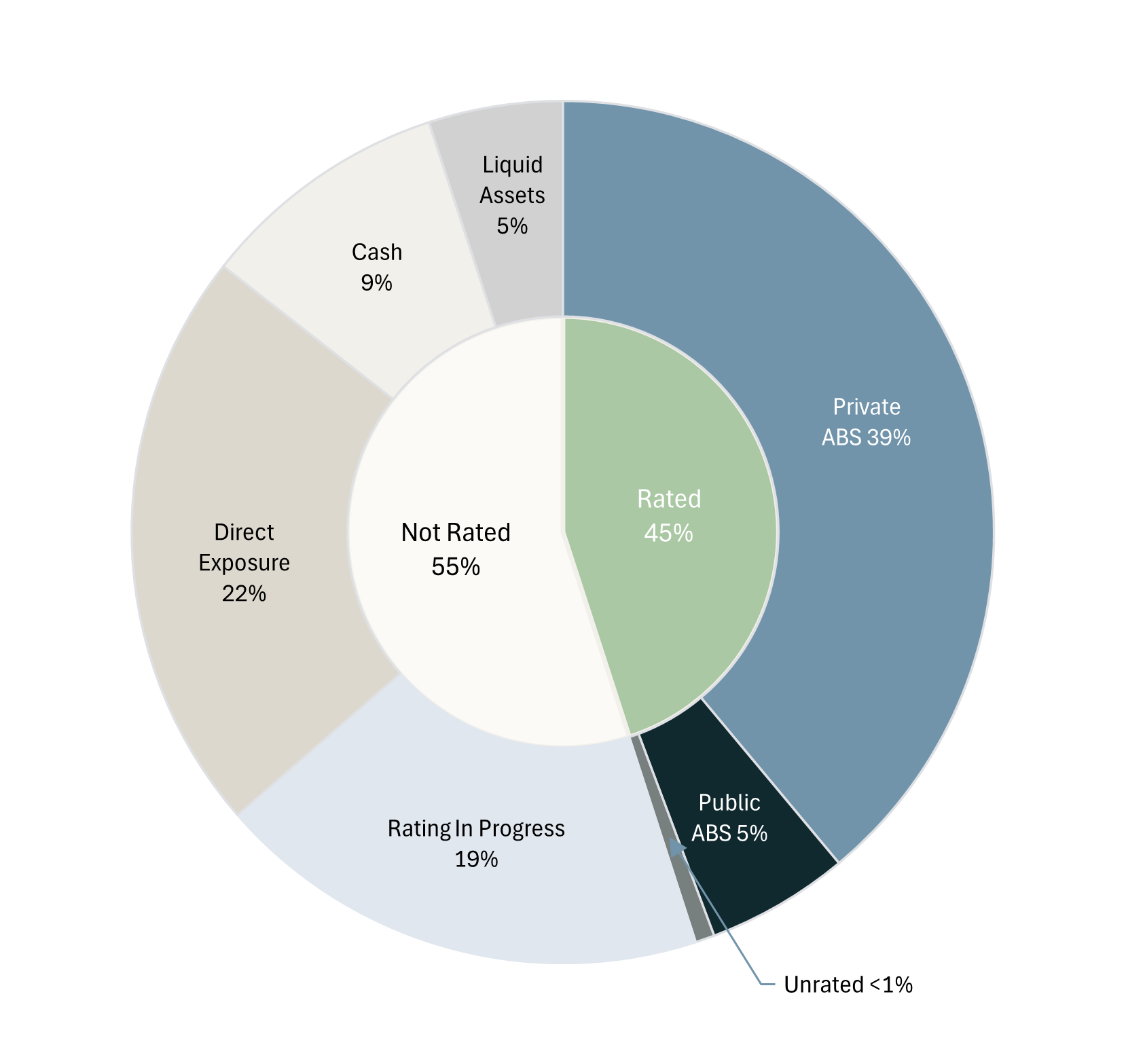

Portfolio Composition**

Credit Quality**

Portfolio Composition:

- Private ABS: refers to assets directly negotiated and held by the fund. The indicative credit rating shown is based on ratings data provided by an independent third party.

- Public ABS: refers to publicly rated securities issued on the market and purchased by the fund. The credit rating shown is based on the public rating provided by S&P or Moody’s.

- Rating in progress: these are Private ABS securities with an indicative credit rating in progress with a target release date of July 2025.

- Direct: individual, senior first mortgages held by the Fund

The portfolio composition chart will be updated monthly with the credit quality and corresponding chart being reassessed quarterly using updated data. We look forward to a growing prevalence of funds disclosing portfolio holdings within the industry and are proud to play our role in that evolution.

The fading affect bias in investing: a cycle of risk

The Psychological Impact of FAB on Investing

Investing isn't just about numbers and market trends; it's also heavily influenced by our own psychology. One fascinating psychological quirk that plays a big role in how we invest is the Fading Affect Bias (FAB). This bias means that the negative emotions from past events fade faster than the positive ones. This mechanism plays an important role in helping us move on from previous pain and can explain why we often look back on stressful periods of our life and recall the silver linings of such events rather than the painful experiences that defined them. When it comes to investing, this psychological bias can lead to an underappreciation of risk and dissatisfaction with more stable investments.

We've all been there—taking a hit from risky investments like stocks, cryptocurrencies, or speculative ventures. The initial pain from these losses is sharp, making us cautious and pushing us towards safer bets. But thanks to the Fading Affect Bias, the sting of those losses fades over time. We start to forget just how bad it was and get lured back by the promise of high returns from risky assets. This cycle can be dangerous. Each time we dive back into high-risk investments, we open ourselves up to potentially big losses. Even though history shows us the risks, the fading of those negative emotions makes the past seem less scary, encouraging us to take those risks again.

A Trip Down Memory Lane: Construction Finance and the GFC

As an asset class, construction finance is often where we see investors forget past pains. In our April 2024 article, 'The Risk Premium of Construction Finance,' we highlighted that following the GFC, an Australian ADI faced impairments in 53.9% of their $2bn+ Construction and Development Loan Advances book. When evaluating investments, it's crucial to remember that not all ~10% returns are created equal; we need to look beyond the headline return to truly understand the risk involved.

The Appeal of Stable Investments

On the flip side, stable investments like bonds, savings accounts, or funds that target capital stability, like the Manning Monthly Income Fund, offer attractive but steady returns without the excitement of higher risk options. These are designed to protect capital and provide consistent income over the long haul. But in a market where high returns from risky assets are often in the spotlight, these stable returns can seem a bit dull. Investors might grumble about the lower returns from these safer investments, forgetting that their main job is to preserve capital and provide a stable source of income. The Fading Affect Bias makes this dissatisfaction worse, as the emotional memory of past losses fades, making the modest returns of stable investments seem less attractive.

Given the psychological traps of the Fading Affect Bias, it's crucial to see the value in investments that target capital stability. These investments offer a balanced approach, mixing growth and defensive assets to provide stability and growth. They're especially good for investors with low to medium risk tolerance and a medium to long-term investment horizon. Capital stable investments can help smooth out the emotional ups and downs that come with high-risk assets. By providing consistent returns and protecting against big losses, they offer a solid foundation for a diversified investment portfolio. This stability is particularly important during market downturns, where preserving capital is key.

Understanding the Fading Affect Bias and its impact on our investment decisions is essential for long-term financial success. While the lure of high returns from risky assets can be tempting, it's important to remember the lessons from past losses and the value of stable investments. Capital stable investments, with their balanced approach, offer a smart path to achieving financial goals while minimising emotional and financial stress. By recognising and addressing the influence of psychological biases, we can make more informed and rational decisions, leading to a more secure financial future.