How investors can access 9% yields in this asset class | Article from Livewire

If there’s one common trait among fund managers that consistently outperform their benchmarks or their competition, it’s that they do one thing and do it well. No distractions, no differences between fund strategies, and little to no divergence from their core mission.

One of those outperforming funds is the Manning Monthly Income Fund. The fund has never had a negative return month from credit in its seven-year existence. When I asked Josh Manning, CEO of Manning Asset Management, how the fund has so consistently outperformed, he points to one thing.

“We’re not doing anything new or different,” Manning said. “Our investment process has been designed to work through all market conditions. We’re simply just repeating that and continuing to deliver the results we have.”

What do you attribute your outperformance to?

Manning: The thing is we’re not doing anything new or different. Our investment process has been designed to work through all market conditions and really what we think we’ve got a very strong investment process and we’re simply repeating that and continuing to deliver the results that we have.

I think in terms of what’s made the strategy so successful, it’s just really about right-sizing our risk limits.

We’ve lost deals because we’ve said we’re not going to take that risk or that’s too big a position but having that discipline to stick to our investment process to have the right risk limits. A lot of managers had a lot of duration on their book and they’ve torn up capital over the last 12 months because of that.

We were very deliberate in terms of how we managed the book around keeping it shorter-dated, particularly through 2020 where there was a lot of market uncertainty.

What investments have detracted from your performance over the past year (if any) and what have you done with them?

Manning: We haven’t had any detractors really over our whole history. We buy assets and some we know will be above investment hurdles, some are below investment hurdle and we just recognise there’s a variety of different reasons why you buy assets.

Firstly, they need to stack up on a risk-adjusted basis. So if something is super low risk then it makes sense to buy it.

The other reason why assets might be slightly below the target is that they have a lot of liquidity in the portfolio. We recognise that’s good from not only an investor perspective but from a flexibility and portfolio perspective.

Have you had to do anything differently this year to deal with the heightened volatility and uncertainty in markets?

Manning: Each quarter, the investment process incorporates a macroeconomic outlook session from the investment committee where we think about what’s happening in the external environment. What’s the context in which we’re making those investments and what are the implications for portfolios.

So there’s already a very robust way in which we think about that external environment and build that into the portfolio construction. Ultimately, the assets that we pick up in the portfolio and how we manage them. It’s a continuing theme, but I think the investment process picks that up and is very well-placed to help navigate that uncertainty.

What are the biggest macro concerns you are monitoring in the portfolio going forward?

Manning: The way I think about it is there are known and unknown risks. So a known risk is the prolific interest rate hiking cycle that we’re going through globally at the moment.

That has implications for unemployment, business investment, business confidence and ultimately, that has implications for the fundamentals of Australian credit markets.

It’s around buying the right assets. So it’s around thinking about these concerns about the macroeconomic environment (and we will always have concerns). We’ll never say we’re not concerned at all. We’ll never go all-in. So we’re about spreading our bets.

But when we make those bets, it’s around stress testing those assets on a very severe basis. So say for an example, an investment had a potential credit loss underneath it of 2%. We knew in a very bad economic environment that could go up three to four times, there will be stress testing at an 8% loss rate.

What kinds of yields are you targeting in the coming year?

Manning: Our main fund is targeting loans that are delivering 9% or higher. While most of our assets deliver yields higher than this, we believe it isn’t a time to be investing based on headline yields. It is the time for being fussy about what deals we participate in, ensuring they fit our risk appetite.

People need to remember, markets are cyclical and when money is flowing into an asset class, it’s easy to get carried along and slowly accept greater and greater risk. We believe in sticking to your risk appetite and looking at investing on a longer term basis that will deliver the best investor outcome.

Is there an area of your market that has huge potential but no one is paying attention to?

Manning: We’ve been quite active in coming in and out of sectors as the fundamentals of those sectors change around. Early on, we had a lot of consumer loans. The fundamentals of those in terms of the risk-adjusted returns came down and we moved our book more into mortgages where we saw a huge opportunity.

More recently, we’ve seen some really strong assets in the business loan space. So we’ve been able to on a relative basis say, well, that’s a better risk-adjusted return, typically a lower risk investment for the return profile.

Speaking of business loans, what kinds of businesses are you wanting to target in this environment of heightened interest rates and risks?

Manning: Business loans is an interesting space, being extremely diverse. Investing in areas such as unsecured lending particularly to plug business cash flow issues is deeply unattractive and not an area we invest in.

Targeting some of the least risky aspects can provide some attractive opportunities. When we invest in this space, we focus on spreading our bets as widely as possible to ensure we do not have large fund concentrations.

We like lending that is naturally suited to businesses when they are growing (e.g. a business buying something to take on an increasing number of orders) and seek opportunities where there are mismatches in business cash flows i.e. they have money due and payable although require funds now for an asset purchase.

Ultimately the cornerstone to our investing is having security over the asset we are lending on. While we are finding good opportunities in this space, we are favouring more traditional non-construction 1st ranking mortgages, given the uncertain outlook placing a limit on our appetite for business loans at present.

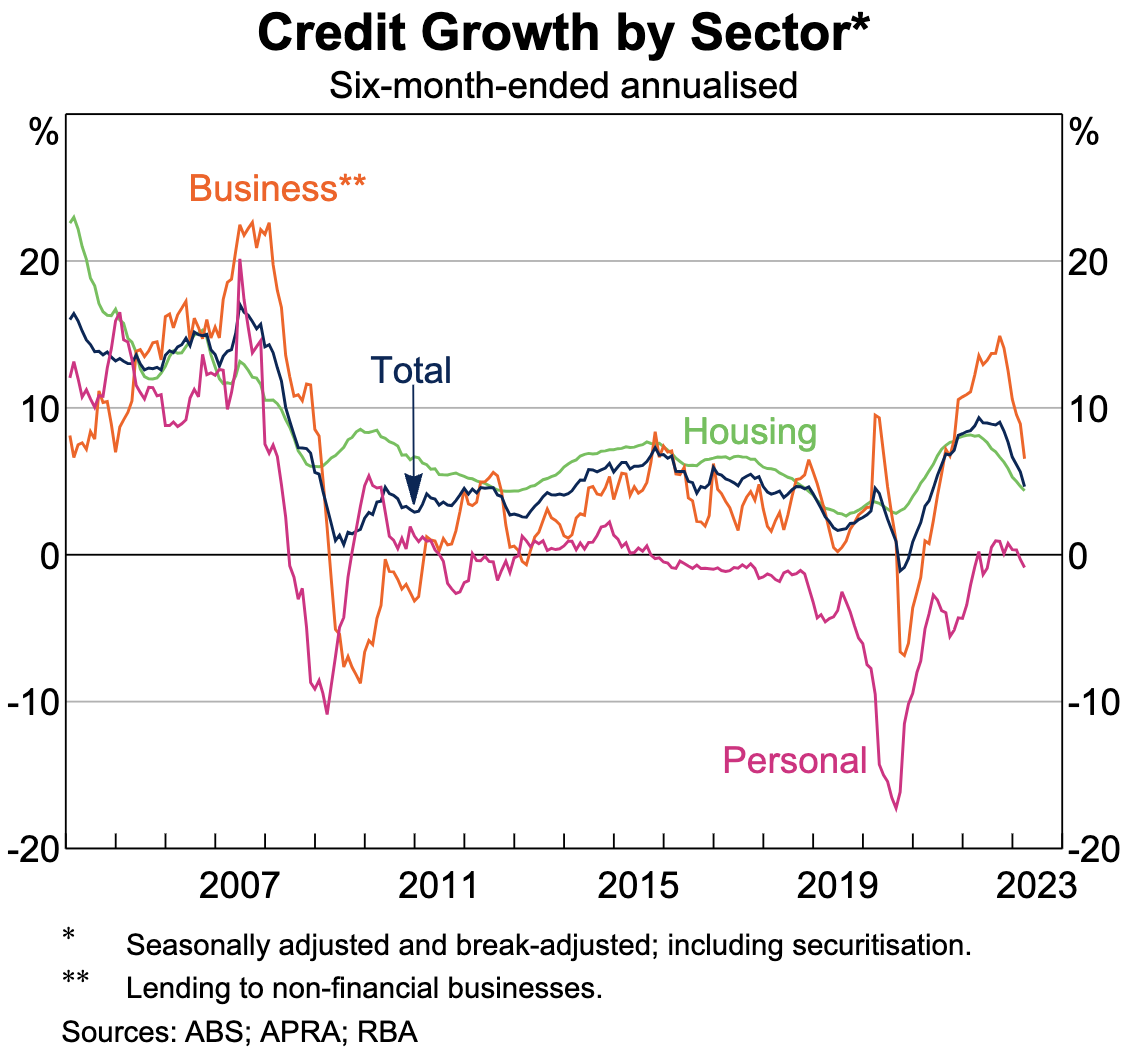

This chart appears in the most recent RBA Statement on Monetary Policy and is one way of reflecting the changes in credit conditions in the Australian economy.

How does this chart affect the way you invest?

Manning: I really like macro big picture things. I think they’re really interesting and they tell you a lot about the tide – which way the tide is running and whether you’re swimming with it or against it. Obviously, growth in this multi-trillion dollar credit market, which we’re participating in here in Australia means we are swimming with the tide.

I get excited about capturing that growth in attractive risk-adjusted assets that have the right risk measures around it. But it’s obviously good that the markets are growing and there’s an increasing number of opportunities out there.

Finally – just for fun – who makes a good investor in your fund?

Manning: We actually quite enjoyed thinking about this question because I think my favourite investors are critical thinkers. So people who read widely, make their own opinions on topics using multiple different sources and they don’t just pick up the front page of an article and take that as gospel.

https://www.livewiremarkets.com/wires/how-investors-can-access-9-yields-in-this-asset-class